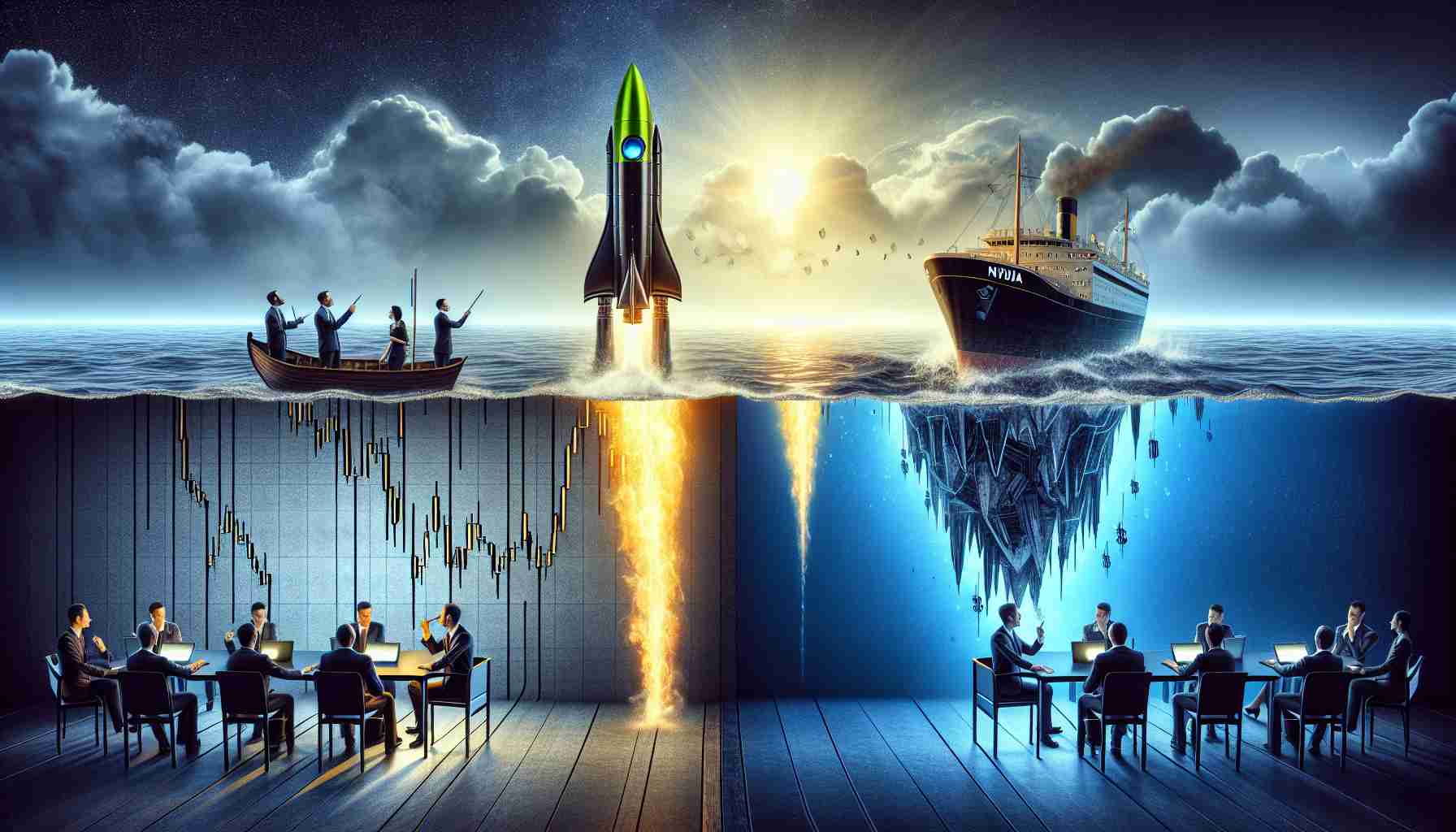

Analysts have been re-evaluating their projections for Nvidia (NVDA) following the company’s latest financial disclosures, which did not meet the high expectations set by investors. Despite being valued at over $3 trillion and holding the title as the second most valuable public entity globally, Nvidia’s stock price experienced a decline post-earnings announcement. This volatility often happens when a company’s stock is anticipated to be flawless.

Currently, the average price target for Nvidia now stands around $170, which reflects a 6% increase from the prior target of $160. Analysts suggest this new projection implies a potential upside of about 20% over the next year, a significant increment compared to the previous forecast of 13%.

Relative value assessments provide some intriguing insights about Nvidia’s stock. Although NVDA is priced at about 35 times its estimated earnings per share, this figure is notably lower than its five-year average, indicating it might be undervalued given its growth trajectory. Analysts project long-term growth rates exceeding 62% for Nvidia, enhancing its attractiveness for investors.

Moreover, with a PEG ratio of 0.6 versus the S&P 500’s average of 2.1, Nvidia appears to be undervalued compared to both its industry and historical standards. Given the consensus among analysts largely favors a ‘Strong Buy’ recommendation, Nvidia remains a pivotal stock to watch in the tech sector.

Maximizing Your Investment Insights: Tips, Life Hacks, and Fascinating Facts

Investing in stocks, especially in high-profile companies like Nvidia (NVDA), can be both exciting and daunting. With fluctuating projections and market volatility, how can you make the most of your investment journey? Here are some essential tips and life hacks, alongside interesting facts that might enhance your investment strategy.

1. Stay Informed with Earnings Reports

Being aware of when companies release their earnings reports is crucial for investors. These announcements can lead to significant stock price changes. Consider setting calendar reminders for major earnings dates to keep track of your investments.

2. Use Financial Ratios to Assess Value

Understanding financial ratios like the PEG (Price/Earnings to Growth) ratio can be a game changer. For companies like Nvidia, a PEG ratio significantly lower than the industry average can indicate potential undervaluation. Research and familiarize yourself with these metrics to make informed decisions.

3. Embrace Diversity in Your Portfolio

Investing solely in high-growth tech stocks can be risky. By diversifying your portfolio across various sectors, you can mitigate risks associated with volatility. Consider a mix of tech, consumer goods, and utility stocks for a balanced approach.

4. Keep a Long-term Perspective

Markets can be volatile in the short term. Maintaining a long-term investment perspective allows you to ride out temporary fluctuations. Nvidia showcases a long-term growth potential exceeding 62%, making it a solid candidate for long-term investors.

5. Join Investment Communities

Engaging with online investment forums or local investment clubs can provide valuable insights and strategies from fellow investors. Sharing experiences and ideas can lead to smarter investment choices.

6. Automate Your Investing

Consider setting up regular contributions to your investment account. This approach, known as dollar-cost averaging, allows you to mitigate the risk of market timing and build your portfolio gradually.

Interesting Fact: Understanding Stock Valuation

Did you know that Nvidia’s stock price is currently assessed at around 35 times its estimated earnings per share? This statistic might indicate a buying opportunity, especially when compared to its five-year average valuations.

The Strong Buy Consensus

With a significant consensus from analysts viewing Nvidia as a ‘Strong Buy’, it’s essential to consider their insights. Analysts often analyze various factors, including market trends and company performance, providing valuable guidance for investors.

For more resources and tips on improving your investment knowledge, visit Investopedia. Investing wisely takes time and knowledge, so arm yourself with information and stay engaged with the markets!