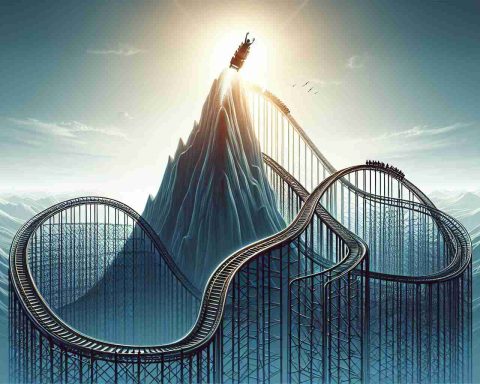

Recent turmoil surrounding Super Micro Computer has left investors questioning the company’s future, yet signs hint at potential recovery. Earlier this year, Supermicro’s stock saw an impressive surge, reaching a peak with gains exceeding 300%. However, starting in August, the company faced a series of setbacks that triggered a painful decline in its stock value.

A Dramatic Series of Events

In late August, the descent began when a report from Hindenburg Research accused Supermicro of accounting malpractices. This revelation resulted in a substantial 19% drop in the company’s stock almost overnight. Following this, in September, the Department of Justice initiated an investigation into Supermicro’s financial practices, spurred by whistleblower allegations. The situation worsened in October when Ernst & Young, one of the Big Four accounting firms, resigned as Supermicro’s auditor.

This tumultuous period escalated further into November. Reports suggested that Nvidia was redirecting some of its orders away from Supermicro, which previously benefited significantly from Nvidia’s technology infrastructure needs.

Hope on the Horizon?

Despite these challenges, Supermicro has been proactive in addressing its issues. The appointment of a new auditing firm, BDO USA, P.C., marks a crucial step forward. Additionally, Supermicro secured an exception from Nasdaq, allowing them to maintain their listing through early 2025.

A Special Committee’s review claimed that the findings, which led Ernst & Young to resign, lacked substantive evidence. This presents a glimmer of hope for investors who have kept faith in Supermicro’s potential to rebound from this turbulent phase.

While uncertainties remain, these developments suggest Supermicro might be on the verge of stabilization, appealing to investors willing to navigate its risks.

Supermicro Faces Downturn but Signals Resurgence: What Investors Need to Know

Supermicro’s Resilient Path Amid Financial Turmoil

Super Micro Computer, a once-prominent player in the tech sector, has encountered considerable financial turbulence in recent months. Despite a staggering 300% surge in stock value earlier this year, recent allegations of accounting malpractices and high-profile investigations have significantly impacted investor confidence. However, several strategic moves have sparked optimism for the company’s future, indicating potential stabilization and recovery for those considering its investment viability.

Key Developments Fueling Investor Hope

The appointment of BDO USA, P.C. as the new auditing firm underscores Supermicro’s commitment to rectifying financial discrepancies and rebuilding trust with stakeholders. This decision follows the abrupt resignation of previous auditor, Ernst & Young, amid controversy over alleged financial improprieties.

Additionally, Supermicro’s proactive engagement with Nasdaq has resulted in a critical exception allowing the company to sustain its listing status through early 2025. This move is vital for retaining credibility and providing a runway for recovery.

Analyzing Market Dynamics and Trends

In the wake of Nvidia’s reported move to cut back orders, a shift largely seen as a response to the prevailing tumult, Supermicro has pivoted to explore new avenues within the tech manufacturing landscape. This strategic redirection aims to mitigate dependency on singular clients and tap into broader market opportunities.

Emerging Insights on Supermicro’s Strategy

Supermicro’s keen focus on diversifying its product and client portfolios highlights its adaptability and drive to innovate amidst adversity. Leveraging its previous successes and technological expertise, the company endeavors to harness upcoming tech trends and strengthen its competitive position.

Considerations for Potential Investors

While Supermicro’s journey toward stabilization is fraught with challenges, its efforts to address governance issues and reassess strategic alliances offer a cautiously optimistic outlook. Prospective investors should carefully weigh these proactive measures against the backdrop of ongoing market volatility.

For more insights into the tech industry and Supermicro’s ongoing developments, visit the main page of Supermicro.

As Supermicro navigates these turbulent waters, monitoring its strategic moves and market responses will remain essential for stakeholders and analysts alike.