The tech giant Nvidia has been at the forefront of the AI revolution throughout 2023, with its stock skyrocketing in value following its incredible technological advances and partnerships. The company reached a monumental status earlier in the year, even surpassing Apple at one point, though it had to retreat to second place later.

Nvidia’s recent earnings report reflected its significant strides, with revenue surging by 94% to $35.1 billion and profits hitting new highs. Despite this success, Nvidia shares experienced a surprising dip after reaching a peak of $152.89 in late November. The stock has declined 15% as of mid-December, puzzling investors amid a generally rising market.

The underlying cause of this pullback isn’t entirely clear, as there hasn’t been any singular event to trigger such a decline. There are, however, various contributing factors, including China’s probe into Nvidia’s 2019 acquisition of networking product company Mellanox, a move seen as anti-competitive by some. Moreover, there is increasing concern over growing competition in AI, as other companies reveal their gains in the sector. Broadcom’s recent strong AI growth forecasts highlight this trend, suggesting the AI pie is being split more widely.

Despite these headwinds, Nvidia’s future prospects remain promising, bolstered by robust demand for its products, particularly the new Blackwell platform. The company anticipates continued revenue growth in the forthcoming quarters, positioning itself as a leader in innovative AI solutions.

Investors are considering whether Nvidia’s current dip offers a strategic buying opportunity, given its sustained growth and competitive edge amidst a shifting tech landscape.

Why Nvidia’s Stock Dip Could Be a Strategic Buying Opportunity

In 2023, Nvidia has solidified its position as a leader in the AI industry, with impressive growth and innovation, although its recent stock performance has puzzled investors. Despite reaching peak heights earlier in the year, Nvidia experienced a surprising 15% decline in stock value by mid-December. Understanding this fluctuation requires a closer look at several new aspects that have emerged in the tech landscape.

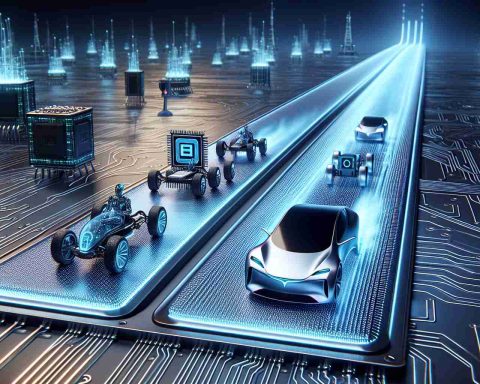

Trends in AI Competition

Nvidia’s dominance in AI is being challenged as more companies push forward with innovative solutions. A notable player, Broadcom, has forecasted significant growth in AI, signaling that market competition is intensifying. As more corporations engage in AI development, the distribution of market share — or the “AI pie” — becomes more complex. This competition could pressure Nvidia to continue innovating and expanding its offerings to maintain its edge.

The Mellanox Acquisition Concerns

One factor contributing to Nvidia’s current stock volatility is the scrutiny surrounding its 2019 acquisition of Mellanox, a company specializing in networking products. China’s investigation into this acquisition raises concerns about potential anti-competitive behaviors, which may impact investor confidence. Maintaining transparency and compliance with international trade regulations will be crucial for Nvidia to navigate this situation successfully.

Key Product Developments: The Blackwell Platform

Nvidia’s future growth is significantly linked to its groundbreaking Blackwell platform, which is poised to meet the increasing demand for sophisticated AI solutions. This platform symbolizes Nvidia’s commitment to remaining at the forefront of technological advancements, promising new features that could redefine AI processing capabilities.

Analyzing the Stock Dip

The recent dip in Nvidia’s stock has left investors wondering if it’s an opportune moment to invest. Analysts highlight that despite temporary setbacks, Nvidia’s long-term trajectory remains optimistic. This decline may represent a strategic buying opportunity for investors who believe in the company’s sustained innovation and market leadership.

Predictions and Future Prospects

Nvidia’s outlook suggests continued revenue growth, driven by the expanding AI sector and the consistent demand for its cutting-edge products. The company’s adaptability in a competitive market will be crucial for maintaining its leadership position. Investors are advised to watch Nvidia’s moves in handling competition and regulatory challenges.

In summary, while Nvidia faces momentary challenges in the stock market and competition, it remains a formidable force in the AI domain. The current dip might be seen as a temporary setback or a strategic entry point for new investors, who could benefit from Nvidia’s ongoing innovation and market dominance.

For more information and updates, visit the official Nvidia website at Nvidia.