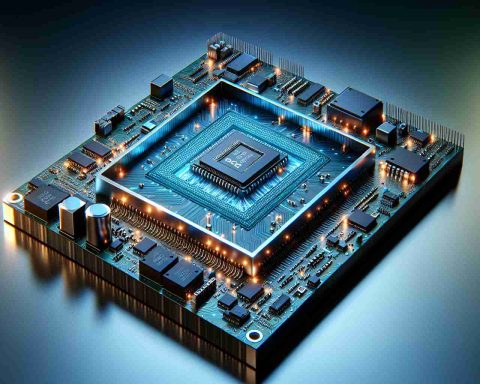

In a groundbreaking announcement, Samsung Electronics has unveiled plans to inject over USD 37 billion into a new semiconductor facility in Texas, USA. This substantial investment is part of a collaboration with the U.S. Department of Commerce under the CHIPS Act, aimed at expanding Samsung’s production capabilities in advanced system semiconductors.

The decision underscores Samsung’s commitment to strengthening the global semiconductor supply chain. Scheduled to commence operations by 2026, this new facility could play a pivotal role in addressing the increasing demand for semiconductors worldwide. However, both the investment figures and timelines are subject to adjustment based on market dynamics.

Samsung Electronics, a powerhouse in the electronics sector, is renowned for producing a diverse array of electronic devices and components, with semiconductors being a core area of focus. The company is dedicated to leveraging cutting-edge technology and innovation to solidify its position in the semiconductor market, catering to global needs.

Despite some challenges this year, with a year-to-date price decline of 38.68%, Samsung remains a strong contender in the market. The company enjoys a market cap of $243 billion and an average trading volume of 20,147, with technical analysts maintaining a consensus rating of “Buy.”

For further insights and analysis on Samsung’s stock performance, potential investors can explore dedicated financial platforms for comprehensive data and informed investment decisions.

Samsung’s Bold Bet: The Future of Semiconductors in Texas

In the ever-evolving landscape of technology, Samsung Electronics is making headlines with its monumental plan to invest over USD 37 billion in building a new semiconductor facility in Texas, USA. This ambitious project is part of Samsung’s collaboration with the U.S. Department of Commerce as part of the CHIPS Act, reflecting a significant push to enhance advanced system semiconductor production capabilities.

Key Features and Specifications

– Investment Scale: Over USD 37 billion earmarked, showcasing Samsung’s strategic commitment to a key industry.

– Location: Texas, USA – a hub known for technological innovation and skilled workforce availability.

– Timeline: Operations are expected to start by 2026, aligning with projected semiconductor market demands.

Insights and Trends

This strategic move by Samsung comes amidst a global surge in demand for semiconductors, driven by technological advancements in sectors like automotive, electronics, and artificial intelligence. The timing underscores the critical need to reinforce the semiconductor supply chain resilience, particularly in light of recent global disruptions.

Innovations and Sustainability

Samsung’s new facility is not just a center for semiconductor production; it is set to be a model of innovation and sustainability. By implementing cutting-edge manufacturing techniques and environmentally sustainable practices, the facility aims to set new standards in the semiconductor industry.

Market Analysis and Predictions

Despite fluctuations in share prices and market challenges, Samsung continues to be a formidable entity in the global electronics landscape. With a current market capitalization of $243 billion, and analysts maintaining a ‘Buy’ rating, Samsung is poised to leverage this investment to enhance its market position substantially.

Security Aspects and Compatibility

The new facility will also focus on integrating enhanced cybersecurity measures to protect valuable data and intellectual property. Compatibility with global semiconductor standards will ensure Samsung’s products meet diverse industrial requirements, fostering wider adoption.

Comparisons and Use Cases

Positioned against other major semiconductor manufacturers, Samsung’s investment represents one of the most ambitious expansions in recent years. This is expected to give Samsung a competitive edge, enhancing its ability to service wide-ranging use cases from consumer electronics to high-performance computing needs.

FAQs

What is the CHIPS Act?

The CHIPS Act is a U.S. government initiative aimed at boosting domestic semiconductor manufacturing and advancing the United States’ technological innovation leadership.

How does this facility align with Samsung’s global strategy?

The new facility aligns with Samsung’s strategy to fortify its position in the semiconductor market and meet increasing global demand through enhanced production capabilities.

What are the potential risks involved in this investment?

Market dynamics and technological advancements could impact investment returns. Additionally, geopolitical and economic fluctuations pose risks that Samsung will need to navigate.

For more information on Samsung’s innovative ventures, visit the official Samsung website.