Every year, financial analysts and investors speculate about what the future holds for the world’s largest companies. In an intriguing prediction for 2025, one analyst bets that Nvidia will emerge as the first-ever $4 trillion company, surpassing giants like Apple and Microsoft.

While Apple is tantalizingly close to this landmark, needing only a slight 4% increase in share price, and Microsoft is not far behind with a required 22% gain, Nvidia’s path to $4 trillion seems more challenging with a needed 21% rise. So, why Nvidia?

The logic lies in the immediate forecasts for Apple and Microsoft, whose upcoming earnings announcements might not be as momentum-shifting as expected. The Federal Reserve’s strategy to slow down interest-rate cuts might further dampen enthusiasm for these tech titans.

Apple’s anticipated sales might not impress, as initial reviews of its generative AI features revealed minimal added value, failing to inspire the huge iPhone upgrade cycle some had hoped for. Meanwhile, Microsoft’s last earnings call suggested a modest outlook, which may not provide the explosive growth spur needed.

Contrarily, Nvidia’s groundbreaking Blackwell graphics processing unit (GPU) architecture promises to revolutionize the market. With claims of superior efficiency and capacity compared to its predecessors, Blackwell has already triggered immense market demand.

Investor anticipation of Nvidia’s promising new technology and positive quarterly updates might propel its share value to unprecedented heights. Some analysts even foresee Nvidia edging past the $5 trillion mark if momentum continues. While everyone remains skeptical, one thing is clear: Nvidia’s potential has captured the market’s imagination.

Nvidia’s Revolutionary Rise: Could It Become the First $4 Trillion Company by 2025?

In the ever-evolving tech landscape, Nvidia has emerged as a potential record-breaker, geared to possibly become the first $4 trillion company by 2025. While this prediction might seem ambitious, several compelling factors fuel this speculation.

Innovative GPU Architecture: Blackwell

Central to Nvidia’s meteoric rise is the anticipated impact of its new Blackwell graphics processing unit (GPU) architecture. Designed for superior efficiency and capacity, Blackwell is claimed to outperform its predecessors, marking a revolutionary shift in the GPU market. This leap in technological prowess has commanded significant interest from investors and tech enthusiasts alike.

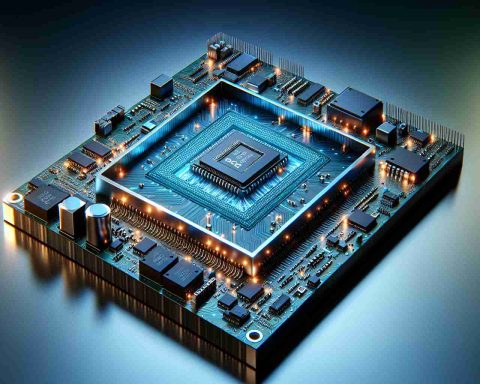

Market Demand and Use Cases

The applications of Nvidia’s technology extend across various booming industries. From powering artificial intelligence models to supporting high-performance computing in data centers, Blackwell GPUs are set to meet the increasing demand for advanced processing capabilities. This widespread applicability is a strong catalyst for potential growth, positioning Nvidia advantageously in the tech market.

Current Market Trends: Ai and Beyond

As the technology sector leans more heavily on AI-driven innovations, Nvidia’s role as a leading supplier of AI-focused hardware underscores its growing influence. The company’s strategic alignment with emerging trends enhances its prospects in capturing a greater market share, furthering its journey toward the $4 trillion mark.

Security Aspects

With increased processing power comes the responsibility of heightened security measures. Nvidia assures that its Blackwell architecture integrates robust security protocols, aiming to protect data integrity both in consumer and enterprise contexts. This focus on security is critical in sustaining investor trust and user confidence.

Analyst Predictions and Market Comparisons

Comparing Nvidia’s potential trajectory with other industry giants sheds light on its unique positioning. Although Apple and Microsoft’s strategies are influenced by factors such as subdued earnings forecasts and broader economic conditions, Nvidia’s specific focus on next-gen GPUs and AI technology seems likely to offer a strategic advantage.

Sustainability and Business Growth Predictions

Nvidia’s emphasis on creating more energy-efficient GPUs aligns with sustainable practices, a critical consideration for modern tech companies. This effort not only contributes to sustainability goals but could also drive Nvidia’s growth. Sustainable innovation is increasingly linked with long-term business success, further enhancing Nvidia’s appeal in the tech sector.

Conclusion

While skepticism about Nvidia’s ambitious target remains, observers cannot ignore the potential embedded in its latest technological advancements. Favorable market trends, innovative architecture, and a strong focus on AI and sustainability collectively enhance Nvidia’s prospects as it reaches for unprecedented milestones.

For more information on Nvidia’s cutting-edge technology and financial strategies, visit the Nvidia website.