The gaming world has been abuzz today as Taiwan Semiconductor Manufacturing Company (TSMC), a titan in the semiconductor industry, saw its stock take an unexpected downturn. Often hailed as the backbone of modern gaming hardware, TSMC’s fate is closely watched by both investors and tech enthusiasts alike. But why is the stock slipping now? The answer might lie in the evolving landscape of artificial intelligence.

Amid Frenzied AI Race

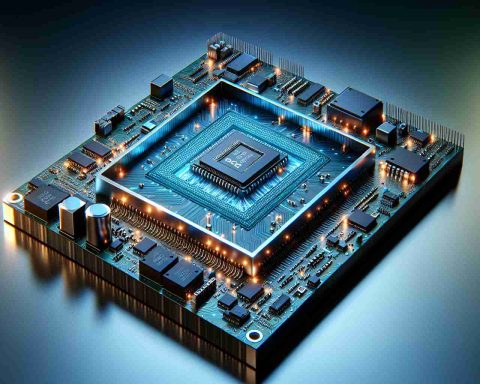

The global race for AI dominance is heating up, demanding increasingly advanced chips and supplies. TSMC has long been at the forefront of this push, supplying critical components to giants like NVIDIA and AMD. However, recent reports suggest delays in production of its cutting-edge 3nm chips due to unexpected technical challenges. These delays might impact the rollout of next-gen AI technologies, leading to concerns among stakeholders.

Geopolitical Tensions

Another layer of complexity is added by ongoing geopolitical tensions. As countries move towards semiconductor self-reliance, TSMC’s central standing in global supply chains becomes an element of vulnerability. Recent moves by governments to bolster domestic semiconductor production cast a shadow over TSMC’s future market share.

Looking Forward

While TSMC’s stock is experiencing short-term volatility, the company’s long-term prospects remain robust. Their continual drive to innovate and address current challenges may eventually stabilize investor confidence. For the gaming industry, which relies heavily on TSMC’s advancements, the future holds transformative possibilities, contingent on the resilient and adaptive nature of semiconductor production.

TSMC’s Pivotal Role in AI and Gaming: Challenges and Future Prospects

As the gaming world and tech industry hold their breath over Taiwan Semiconductor Manufacturing Company’s (TSMC) recent stock volatility, there are deeper layers to explore regarding the company’s pivotal role in cutting-edge technology sectors, specifically artificial intelligence (AI) and gaming. This article delves into the nuances of TSMC’s current challenges and future potential, highlighting new insights and market dynamics.

AI Innovations and Their Impact on TSMC

TSMC’s influence stretches beyond the gaming industry into the rapidly evolving domain of artificial intelligence. The demand for advanced semiconductor chips to power AI applications has soared, positioning TSMC as a key supplier for leading tech companies, including NVIDIA and AMD. Despite technical setbacks in the production of 3nm chips, innovations in AI hardware underscore the importance of overcoming these challenges. The potential for AI-driven sectors to expand exponentially remains a promising opportunity for TSMC to capitalize upon, given successful resolution of production hurdles.

Geopolitical Challenges and Market Adaptation

In an era where geopolitical tensions are reshaping global semiconductor supply chains, TSMC finds itself navigating through a complex international landscape. Countries are increasingly striving for semiconductor independence, which poses both a risk and an opportunity for TSMC. As governments push for domestic production capabilities, TSMC’s strategic response and adaptations could determine its competitive edge. The company’s ability to form partnerships and expand operations beyond Taiwan’s borders might be crucial in maintaining its market presence amid shifting geopolitical currents.

Market Analysis and Future Predictions

The semiconductor industry, shaped by continuous innovation, is vital for technological advancements in various domains. Analysts predict that despite current fluctuations, TSMC’s commitment to overcoming technical challenges and geopolitical navigation will likely restore investor confidence. The anticipated breakthrough in 3nm chip production could significantly enhance TSMC’s market share, fueling next-generation technologies across sectors.

TSMC’s role in advancing not just gaming technology but also broader scientific and technological applications worldwide is irreplaceable. As the company continues to refine its strategies and production capabilities, the long-term outlook for both the semiconductor industry and TSMC appears promising, suggesting a potential rebound and stabilization in the stock market.

The Role of Sustainability in Semiconductor Manufacturing

As environmental concerns become increasingly prominent, TSMC is under scrutiny to adopt sustainable manufacturing practices. The company’s efforts towards environmental sustainability could set a new standard in the industry, addressing both ecological impacts and regulatory pressures. Innovations in energy-efficient technologies and sustainable resource management could play a pivotal role in stabilizing their market position and fostering long-term industry growth.

TSMC’s journey through these turbulent times is marked by its commitment to innovation and adaptability, crucial elements in maintaining its dominance in the semiconductor sector. Stakeholders and enthusiasts alike continue to watch closely as TSMC strives to transform current challenges into opportunities for advancement and sustainability. For more insights into TSMC’s role in the global tech industry, visit TSMC.