The Future of Trading is Here

Tesla, Inc. (TSLA) is making headlines not just as an automaker but also as a game-changer in financial markets. The company’s foray into utilizing artificial intelligence (AI) is steering a revolution in how traders analyze market data.

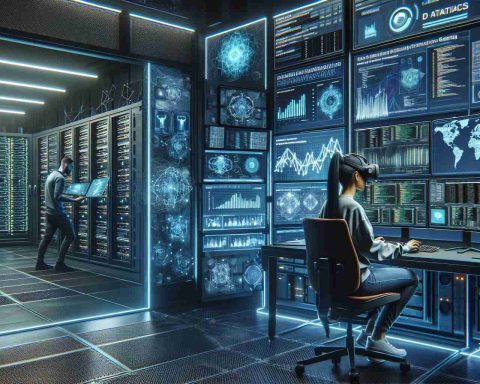

Tesla’s latest initiative harnesses cutting-edge AI algorithms designed to sift through extensive market information in real-time. This novel technological approach empowers investors to make more precise and timely choices in trading, reshaping performance expectations on major stock exchanges like NASDAQ. With enhanced predictive capabilities, Tesla is establishing itself as a leader in the application of AI for smart trading strategies.

Moreover, this strategic pivot signifies an evolution in trading practices that could democratize financial insights. The potential for broader accessibility may grant even novice investors the tools needed to navigate the complexities of the market, thereby raising overall financial literacy.

Tesla’s emphasis on efficiency and data-driven decision-making not only optimizes trading practices but could also promote environmentally responsible investments. By channeling investments toward sustainable initiatives, the company is aligning its financial strategy with global sustainability efforts.

Looking ahead, as Tesla spearheads the integration of AI into finance, we may witness a paradigm shift where technology plays an integral role in reshaping market dynamics. This is merely the beginning of a profound transformation in how investments are conducted and perceived in the future.

The Future of Trading: Navigating Through Artificial Intelligence

Tesla, Inc. (TSLA) is not just reshaping the automotive landscape; it is also pioneering a transformative approach to trading in financial markets through the utilization of artificial intelligence (AI). By integrating sophisticated AI algorithms that can analyze vast amounts of market data in real-time, Tesla is revolutionizing how investors make decisions on key platforms such as NASDAQ. The implications of this advancement extend far beyond financial returns, affecting the environment, humanity, and the broader economy.

Impact on the Environment

Tesla’s commitment to enhancing predictive trading capabilities is closely tied to its broader mission of promoting sustainable practices. By optimizing trading decisions towards investments in sustainable initiatives, the company facilitates a shift in capital flows toward environmentally responsible businesses. This could lead to increased funding for green technologies and renewable energy projects, essential for combating climate change and fostering sustainable development. As traders gain more insights into which companies prioritize sustainability, the collective financial focus may encourage businesses across various sectors to adopt greener practices, contributing to environmental preservation.

Effects on Humanity

The democratization of financial insights brought about by Tesla’s AI integration will likely empower a broader demographic of investors, including those who traditionally might have been excluded from the financial markets. By providing novice traders access to sophisticated analytical tools, there will be an increase in financial literacy among the general populace. This educational shift could enable more individuals to participate in the economy actively and competitively. Such empowerment has the potential to contribute to an inclusive future where diverse voices can influence market trends, create job opportunities, and build wealth.

Economic Ramifications

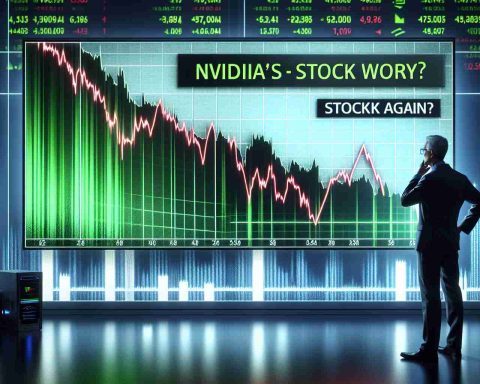

Economically, the shift to AI-driven trading strategies could redefine market dynamics. With enhanced accuracy in predictions, volatility in the stock market may decrease, resulting in more stable investment environments. Companies that adopt AI for trading could experience an increase in investor trust and, consequently, capital inflows. Furthermore, as businesses become progressively aware of the market’s responsiveness to sustainability, they may adjust their strategies accordingly, aligning corporate outcomes with environmental impact. This could foster a new economic paradigm where profitability and sustainability coexist, influencing corporate governance on a global scale.

A Vision for the Future

As Tesla leads the charge in the integration of AI within financial sectors, we stand on the brink of a paradigm shift that will redefine investment strategies and market interactions. This evolution is not just a technical innovation; it is a precursor to a future where AI not only enhances financial outcomes but also facilitates the necessary changes for a sustainable planet. The convergence of technology, finance, and environmental responsibility could herald a new era of market behavior rooted in ethical considerations.

Ultimately, the future direction Tesla takes may serve as a model for other industries. A world where informed investors prioritize sustainability, driven by innovative technologies, can accelerate the transition toward a greener economy, embodying the values of humanity’s collective responsibility for our planet. The marriage of AI and finance symbolizes more than economic activity; it represents humanity’s stride toward a compassionate and sustainable future.

The AI Revolution: How Tesla is Transforming Trading for Everyone

The Future of Trading is Here

Tesla, Inc. (TSLA) is not just synonymous with electric vehicles; it is also pioneering advancements in financial technology that are reshaping the trading landscape. The company’s innovative use of artificial intelligence (AI) is setting new standards in how market data is analyzed, ultimately transforming trading strategies.

Breaking Down Tesla’s AI-Driven Trading Approach

Tesla’s recent initiatives involve sophisticated AI algorithms that can process vast amounts of market data in real-time. This revolutionary approach enables traders to gain insights faster and make more informed decisions. By enhancing predictive capabilities, Tesla aims to provide investors with a competitive edge on platforms like NASDAQ.

Pros and Cons of Tesla’s AI in Trading

Pros:

– Real-Time Analysis: The ability to assess market conditions rapidly helps investors react to trends as they happen.

– Data-Driven Decisions: The AI-driven insights promote a well-informed decision-making process.

– Accessibility: Novice traders gain access to tools and analysis that were once available only to financial professionals, potentially democratizing trading.

Cons:

– Reliance on Technology: Over-dependence on AI can lead to risks if the algorithms fail or provide inaccurate predictions.

– Market Volatility: The integration of AI in trading might lead to increased market volatility due to rapid trades based on algorithmic signals.

Use Cases of AI in Tesla’s Trading Environment

1. Risk Assessment: AI algorithms can predict potential risks by analyzing historical data patterns.

2. Portfolio Optimization: Automated tools can help manage diverse investment portfolios to optimize returns while minimizing risk.

3. Trend Analysis: Investors can utilize AI to identify emerging market trends and opportunities.

Security Aspects of AI Trading

With the rise of AI in trading, security becomes a paramount concern. Tesla is likely to implement stringent security measures to protect sensitive financial data and ensure that algorithmic trading systems are shielded from cyber threats. The integrity of trading systems is essential for maintaining investor confidence and market stability.

Sustainability Focus in Financial Strategies

Tesla’s commitment to sustainability extends beyond its products; it is also evident in its financial approaches. The firm emphasizes funding environmentally responsible investments through AI-powered insights. This aligns with a growing trend among investors who prefer companies with strong sustainability practices.

Market Trends and Predictions

As Tesla leads the charge in AI integration into finance, the market may witness several pivotal changes:

– Increased Adoption of AI: More companies will likely begin to adopt AI technologies for trading and financial forecasting.

– Shift in Trader Dynamics: As beginner investors gain access to sophisticated tools, traditional trading roles may evolve or diminish.

– Greater Transparency: AI could enable more transparent trading practices, as algorithms can analyze compliance and ethical trading.

To stay updated with insights into Tesla’s innovative financial strategies and the evolving landscape of AI in trading, visit Tesla’s official site.

Conclusion

Tesla’s groundbreaking efforts in applying AI to trading practices illustrate a major shift in the financial landscape. By leveraging technology to enhance data processing, decision-making, and sustainability, Tesla is not only changing the way individuals approach investing but is also redefining the metrics of success in the financial sector. As AI continues to evolve, so too will the paradigms of trading, investment, and financial literacy.

Stay tuned as we witness these changes unfold in real-time, creating opportunities and challenges in equal measure.