Intel’s Strategic Renaissance: A New Era of Growth

In a world where Nvidia’s dominance in AI technologies steals headlines, a quiet revolution is unfolding at an unexpected player: Intel. While Nvidia’s meteoric rise, powered by innovations like ChatGPT, has drawn much attention, investors may find untapped potential in Intel’s dramatic transformation.

Intel is undertaking a bold $100 billion initiative to overhaul its domestic chip production infrastructure, signaling a strategic pivot that could redefine its industry role. This massive investment underscores Intel’s ambition to become a leading third-party chip manufacturer, carving a unique niche in the semiconductor market.

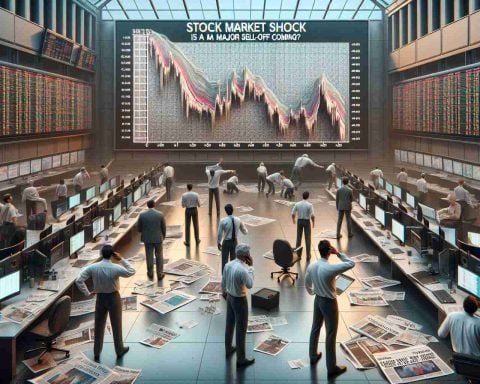

Amid challenges and leadership shifts, Intel’s new course is capturing interest from technology giants, including the likes of Microsoft. Even Nvidia appears to consider Intel’s revamped capabilities for future chip orders, highlighting this strategy’s potential. Although Intel’s stock currently lags behind its peers, market analysts suggest it may be significantly undervalued—a ripe opportunity for discerning investors.

Why Intel Matters in the Tech Landscape

Intel’s strategy aligns with upcoming trends that emphasize localized manufacturing amid global supply chain concerns. Its focus on enhancing American chip-making infrastructure could provide a strategic advantage, positioning Intel as a pivotal player in meeting the world’s increasing demand for semiconductors.

As geopolitical tensions underscore the importance of a resilient tech supply chain, Intel’s American-based resources stand to offer a competitive edge. For those exploring investment avenues beyond the overvalued Nvidia, Intel presents a potentially lucrative prospect.

Ready for a New Tech Era?

Intel’s transformation could lead to a reinvigorated presence in the tech ecosystem, offering innovative alternatives to Nvidia’s AI-focused solutions. This strategic shift invites investors to partake in an evolving narrative where foresight could translate into substantial gains. Discover more about Intel’s initiatives and future prospects on its official platform.

Intel’s Strategic Renaissance: Pioneering Change in Global Chip Manufacturing

In a tech landscape often fixated on AI developments and Nvidia’s headline-grabbing innovations, Intel is orchestrating its own quiet yet profound revolution. Its $100 billion investment in overhauling domestic chip production aims to reshape its role in the semiconductor market, positioning itself as a pioneering force in third-party chip manufacturing.

Environmental Implications of Intel’s Transformation

Intel’s ambitious initiative to bolster its domestic production capabilities could have far-reaching environmental impacts. By focusing on strengthening American chip-making infrastructure, Intel may contribute to reducing the global carbon footprint associated with long-distance transportation of key technologies and materials. The shift towards localized manufacturing can minimize the environmental costs typical of extended supply chains, such as emissions from shipping and air transport. This approach aligns with the increasing emphasis on sustainability in manufacturing processes, which is crucial for mitigating climate change.

Impact on Humanity

The development of a resilient, localized semiconductor supply chain could have significant repercussions for the future of humanity. Semiconductors are the building blocks of modern technology, powering everything from smartphones to the AI systems that are transforming industries. By fortifying domestic manufacturing, Intel is not only addressing current supply chain vulnerabilities but also preparing for a future where technology continues to interlink with daily life. This strategic foresight ensures that growing demands and technological advancements can be met sustainably, ultimately enhancing the quality of life.

Economic Reflections and Global Dynamics

The economic implications of Intel’s transformation are noteworthy. By investing heavily in U.S.-based production, Intel not only boosts domestic job creation but also shifts the economic balance within the semiconductor industry. This move can stimulate economic growth and innovation within the United States, potentially reducing dependence on foreign manufacturing hubs. Moreover, amid geopolitical uncertainties and trade tensions, a strong domestic semiconductor supply chain could provide economic stability and reinforce national security.

Connection to the Future of Humanity

Intel’s strategic shift is a microcosm of broader trends that will likely shape humanity’s future—a future where regional self-sufficiency and sustainable practices define industrial success. As technology becomes increasingly integral to addressing global challenges, from climate change to healthcare, securing a robust and environmentally responsible tech infrastructure is essential. Intel’s endeavor, therefore, not only reflects a corporate renaissance but also signals an evolution in how industry giants can contribute to a more sustainable and interconnected future for humanity.

In pursuing this transformative path, Intel encourages a reconsideration of investment strategies, suggesting a future where aligning with forward-looking, responsible initiatives could yield both economic and societal dividends.

Intel’s $100 Billion Gamble: A Closer Look at Its High-Stakes Revolution

As the tech world closely monitors Nvidia’s advancements, Intel is making waves with its ambitious strategic overhaul. Once a traditional leader in silicon production, Intel is now positioned to redefine its role within the semiconductor industry through a substantial $100 billion transformation plan, aimed at revitalizing its domestic chip production capabilities.

Pros and Cons of Intel’s $100 Billion Initiative

Pros:

– Strategic Manufacturing Shift: By enhancing its American chip-making operations, Intel is aligning itself with the growing trend toward localized production. This shift bolsters supply chain resilience amidst global uncertainties, which is a significant advantage in the current geopolitical climate.

– Potential for Market Leadership: Intel’s investment could see it emerge as a leading third-party chip manufacturer, providing services to tech giants like Microsoft and potentially even Nvidia.

– Undervalued Investment Opportunity: Analysts suggest that Intel’s stock is undervalued, offering a potentially lucrative opportunity for investors seeking alternatives to higher-priced stocks like Nvidia.

Cons:

– Market Perception and Stock Performance: Despite its strategic initiatives, Intel’s stock performance has lagged, and convincing the market of its potential is an ongoing challenge.

– Comparative Innovation Pace: Nvidia’s momentum in AI innovations has set a high bar, and Intel needs to accelerate its pace to capture and maintain market interest.

Trends and Insights: The Future of Semiconductor Manufacturing

The semiconductor industry is witnessing rapid transformations as tech companies seek to navigate supply chain vulnerabilities and geopolitical challenges. Intel’s domestic production strategy taps into these trends, promising to offer more robust and secure solutions that meet the increasing demands for semiconductors. By focusing on improving its chip manufacturing capabilities, Intel is strategically positioning itself to capture new market opportunities.

Innovations Await: What to Expect from Intel

Looking ahead, Intel’s new direction could pave the way for significant innovations, specifically in manufacturing processes and semiconductor designs. By focusing on cutting-edge technology and infrastructure improvements, Intel aims to deliver competitive alternatives to Nvidia’s AI-driven products.

Compatibility and Market Analysis

Intel’s revamped strategy could enhance its compatibility with a broader range of technology partners, including companies like Microsoft, which are looking for resilient and reliable chip solutions. The company’s commitment to infrastructure expansion could position it favorably in the global market, presenting insights into how it might capture a more substantial share of the semiconductor market.

Security Aspects and Sustainability Initiatives

With its investment in domestic manufacturing, Intel is not only enhancing its supply chain but also emphasizing security in technology production. This focus on security is crucial as the demand for semiconductors grows and as they become integral to critical infrastructures worldwide. Additionally, attention to sustainable manufacturing practices could further enhance Intel’s market appeal, contributing to reduced environmental impact.

Predictions suggest that Intel’s massive overhaul could spark a new era of growth and innovation for the company, setting new benchmarks in the industry. To explore more about Intel’s future plans and ongoing initiatives, you can visit its official Intel website for the latest updates.