The Rise of a Hedge Fund Legend

Founded in 1989 with just $35 million, Israel Englander’s Millennium Management has skyrocketed to manage over $70 billion, earning its status as a leading player in the hedge fund world. Investors eagerly anticipate the firm’s quarterly 13F filings, which reveal its investment strategies and holdings.

Millennium operates as a “pod shop,” meaning it assigns capital to various independent teams, each with unique approaches, allowing for decentralized decision-making. Despite this structure, Englander’s influence remains significant, especially in key hiring decisions, suggesting that Millennium’s portfolio managers work under his watchful eye.

Recently, however, the firm made headlines by dramatically shifting its investment focus. In the third quarter, Millennium divested from tech giants like Nvidia and Palantir, selling substantial stakes amid concerns over inflated valuations that characterize the current market.

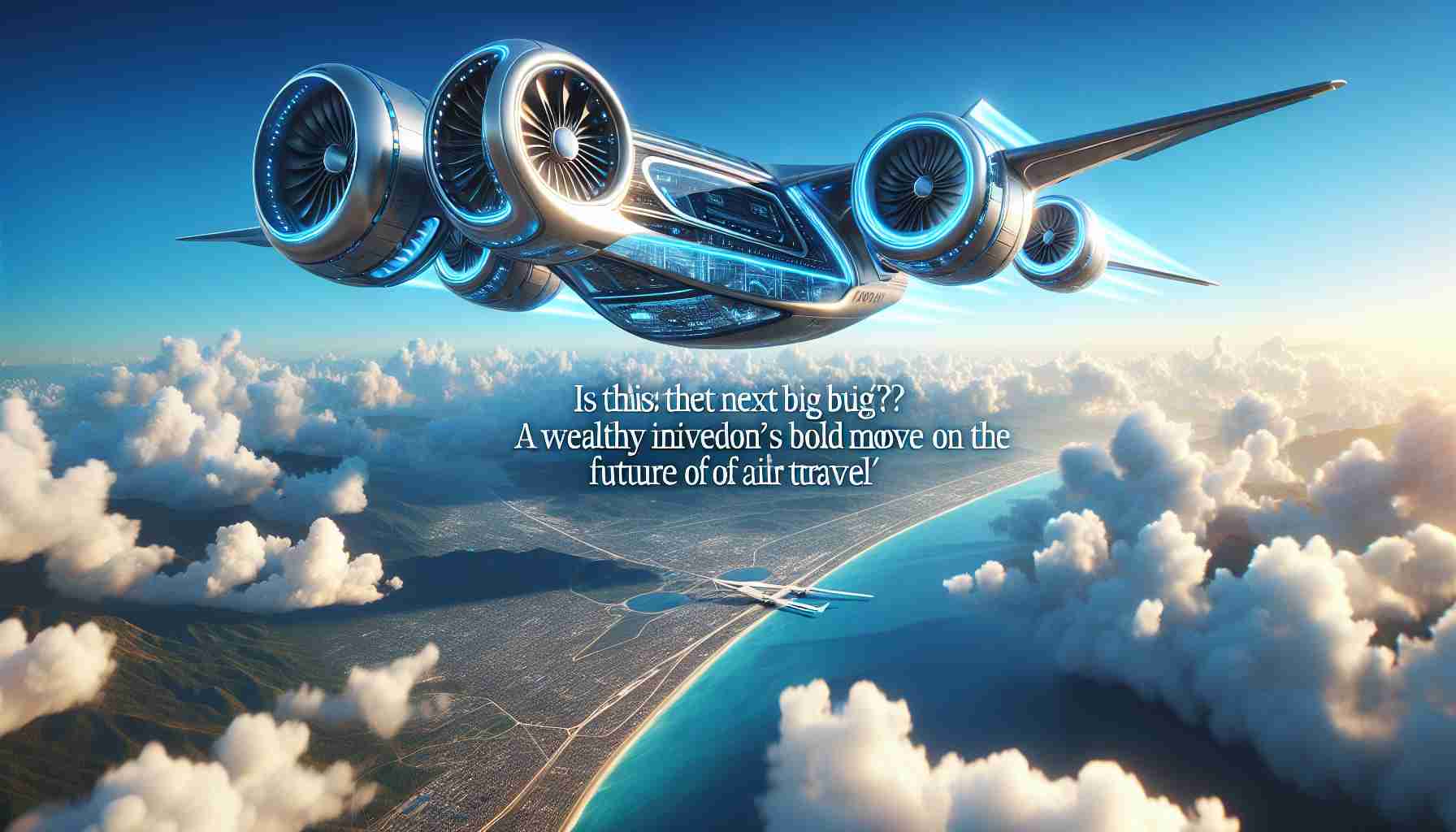

In contrast, the fund made a splash by investing in Archer Aviation, acquiring over 3.2 million shares worth approximately $9.8 million. Positioned at the forefront of electric air taxis, Archer aims to revolutionize urban transport. The firm has made notable progress, securing FAA approvals and planning a groundbreaking air taxi network in Los Angeles.

This investment into Archer reflects a daring bet on the future of aerial mobility, with investors eyeing the potential for remarkable returns in this emerging industry. If successful, Archer could redefine travel, promoting significant gains in a burgeoning market.

Investing Insights and Life Hacks Inspired by Millennium Management

In light of the recent developments at Millennium Management, we can learn valuable investing tips, life hacks, and interesting facts to enhance our financial literacy and decision-making prowess. Here are some strategies and insights to consider.

1. Diversify Your Investments

Just like Millennium’s unique “pod shop” structure allows for diverse independent teams with varying strategies, individual investors should consider diversifying their portfolios. This can involve investing in a mix of asset classes, sectors, and geographic regions to mitigate risks and capitalize on different market opportunities.

2. Stay Informed About Market Trends

Keeping an eye on current market trends, especially in sectors like technology and emerging industries (like aerial mobility with Archer), is crucial. Regularly reading financial news, reports, and analysis can help you make informed decisions. Utilize resources like Wall Street Journal for in-depth financial insights.

3. Understand the Power of Quarterly Reports

Investors watch Millennium’s quarterly 13F filings with great interest because these documents reveal what investments major funds are making. You too can take advantage of quarterly earnings reports from your investments to assess their performance and make adjustments as needed.

4. Embrace Innovative Technologies

Millennium’s investment in Archer Aviation symbolizes the growing importance of technology in our lives. As an individual investor, consider allocating a portion of your investments to innovative companies in sectors like renewable energy, biotechnology, or electric vehicles, which are anticipated to thrive in the coming years.

5. Keep Emotions in Check

Effective investing requires a cool head. Just as Millennium Management’s structured approach enables rational decision-making, you should avoid emotional reactions to market fluctuations. Develop a disciplined strategy that reflects your long-term goals, and stick to it.

6. Look for Long-Term Potential

Millennium’s bet on the future of aerial mobility with Archer Aviation highlights the importance of investing in businesses that show long-term potential. Seek out companies that not only have current value but also demonstrate strong growth prospects for the future.

7. Network with Other Investors

Join forums and attend events that focus on investing. Sharing insights with peers can lead to new ideas and strategies. Engage with communities on platforms like LinkedIn to make connections that can enrich your investing knowledge.

Interesting Fact:

Did you know that the hedge fund industry has evolved significantly since the 1980s, with assets under management increasing from less than $40 billion to over $3 trillion globally? This growth attests to the effectiveness of varying investment strategies and the quest for innovation in finance.

By incorporating these tips into your investment strategy, you can enhance your financial acumen and potentially reap the rewards of a well-structured portfolio. Always remember to research thoroughly and tailor your approach to fit your financial goals. For more insights and resources, visit Investopedia.