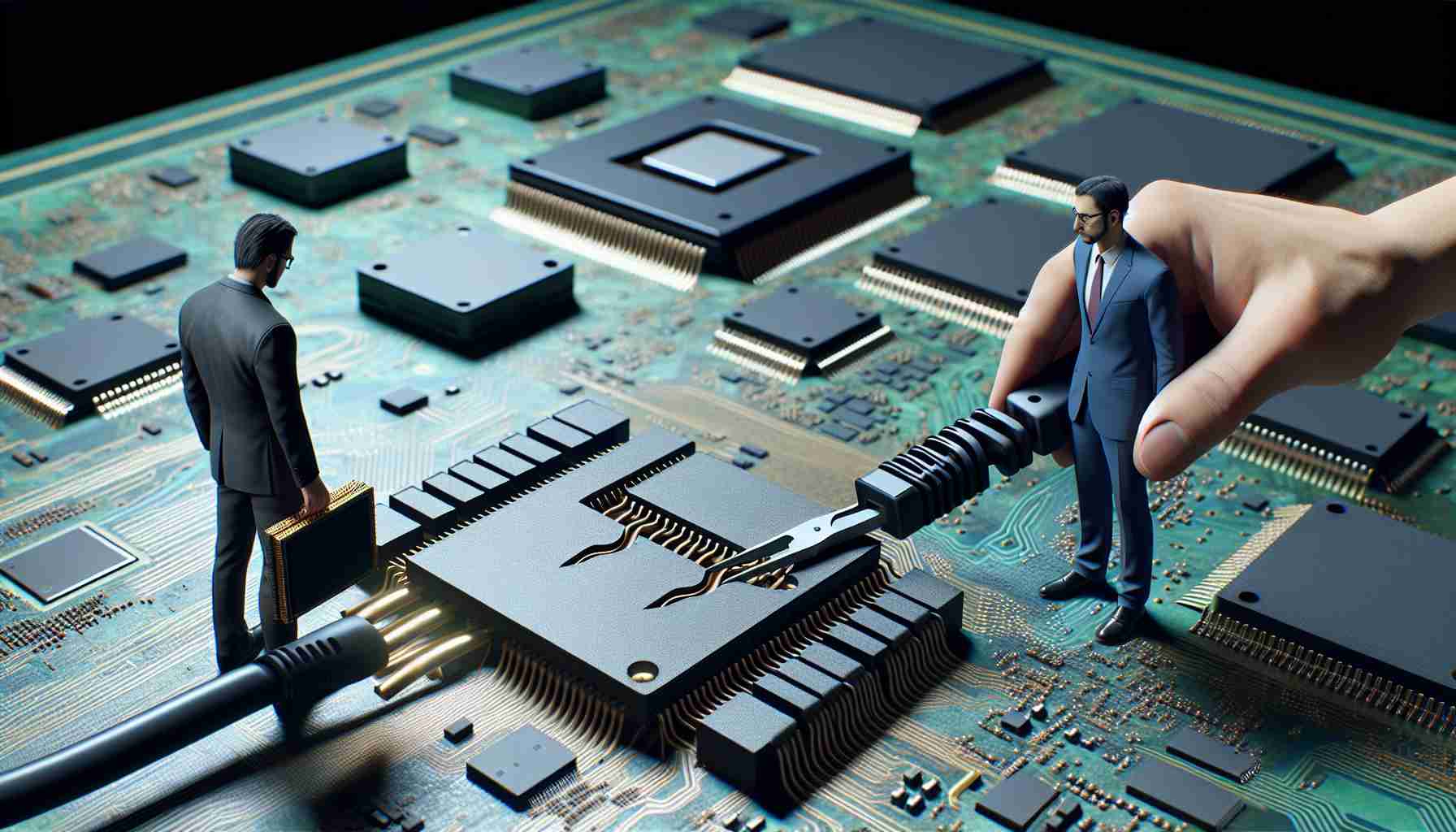

In a dramatic move, Taiwan Semiconductor Manufacturing Co (TSMC), a leading chipmaker, has terminated its partnership with Singapore’s PowerAIR. The split occurred after one of TSMC’s chips was identified in a Huawei AI processor, raising eyebrows across the industry.

In early 2024, TSMC also halted deliveries to China-based Sophgo, following a revelation that chips ordered by Sophgo were used in Huawei’s Ascend 910B system. This decision underscores the tangled web of international technology alliances and the growing implications of geopolitical tensions.

This comes against a backdrop of heightened scrutiny from Washington, which slapped restrictions on Huawei back in 2020 due to national security concerns. The ongoing tensions may soon impact other tech giants like Nvidia, subject to potential U.S. sanctions that could limit AI chip exports to China.

TSMC’s financial performance has been robust, with its stock price soaring over 105% in the past year. The company’s revenues climbed to 2.89 trillion New Taiwan dollars, marking a 33.9% increase year-on-year. In the December quarter alone, it reported $26.3 billion in revenue, exceeding expectations. Despite this financial success, China remains crucial for TSMC, expected to generate 12% of its projected $88.3 billion in total revenue in 2024.

For investors keen on the semiconductor market, options like Invesco Semiconductors ETF (PSI) provide promising avenues. Meanwhile, TSMC’s stock reflects positive momentum, making waves in premarket trading.

TSMC’s Strategic Moves Amidst Geopolitical Tensions: What Lies Ahead?

The recent announcement by Taiwan Semiconductor Manufacturing Co (TSMC) to end its collaboration with Singapore’s PowerAIR and halt deliveries to China’s Sophgo is igniting substantial discussions in the tech industry. These decisions have emerged amidst rising geopolitical tensions, particularly between the U.S. and China, underscoring significant shifts in the global semiconductor landscape.

How TSMC’s Decisions Reflect Broader Market Dynamics

TSMC’s move to disengage from PowerAIR followed revelations that its chips were implicated in a Huawei AI processor. This situation highlights a critical aspect of TSMC’s strategy—navigating complex international technology alliances while maintaining compliance with U.S. regulations that impose restrictions on Huawei due to national security concerns.

The halt on Sophgo deliveries indicates a broader trend of heightened scrutiny and strategic reconsiderations among tech firms worldwide. This decision, particularly, adds a layer of complexity to existing supply chain relationships, where technology giants must continuously evaluate partnerships against evolving political pressures.

U.S. Restrictions and Their Ripple Effects

Washington’s 2020 restrictions on Huawei have set a precedent that is likely to affect more companies, with Nvidia being a notable contender that might face potential sanctions. Such limitations on AI chip exports to China represent a critical concern for manufacturers aiming to maintain growth in one of the world’s largest markets. The landscape could evolve further if other tech firms face similar export constraints.

TSMC’s Financial Strategy Amid Challenges

Despite these geopolitical challenges, TSMC’s financial performance remains robust. The company has reported a significant stock price increase of over 105% in the past year. Revenues have risen to 2.89 trillion New Taiwan dollars—a 33.9% year-on-year upswing—which is impressive given the current tensions. TSMC expects China to account for 12% of its projected $88.3 billion revenue in 2024, showcasing the market’s importance.

For investors considering the semiconductor market, financial products like the Invesco Semiconductors ETF (PSI) continue to offer compelling opportunities. Additionally, TSMC’s current positive stock momentum continues to generate interest, especially in premarket trading.

Future Insights and Industry Trends

With geopolitical tensions influencing strategic decisions, the semiconductor industry is witnessing a reshaping of alliances and market strategies. Analysts predict an increase in diversification of supply chains and a greater emphasis on regional partnerships to mitigate risk. Moreover, the focus might shift towards developing semiconductor technologies that are less susceptible to trade restrictions and geopolitical disruptions.

Conclusion: Navigating the Future

As semiconductor giants like TSMC work through these challenges, the broader tech industry is keeping a close watch on the implications of geopolitical shifts. Investors and analysts alike will be looking to how these companies balance financial performance with strategic compliance to maintain growth trajectory in a rapidly changing global market.

For more information on TSMC and the latest in semiconductor news, visit the TSMC website.