- Nvidia’s Q4 2025 financials showcase a robust performance with revenue hitting $39.3 billion, reflecting a 78% increase year-over-year.

- The Data Center segment, bolstered by the Blackwell architecture, generated $115.2 billion in fiscal 2025, emphasizing its significant role in Nvidia’s success.

- Blackwell’s sales, marking the fastest product ramp in the company’s history, surpassed $11 billion in Q4.

- Businesses are aggressively scaling AI infrastructure, starting with a minimum of 100,000 GPUs per installation, to meet growing AI demand.

- Nvidia’s technology powers advanced AI models requiring substantial computing resources, optimizing reasoning AI inferences and enhancing efficiency.

- Nvidia continues to lead in AI innovations, driving speed, scale, and technological evolution, cementing its status as an industry leader.

In the dynamic world of technology, Nvidia has crafted a narrative akin to a thrilling blockbuster, and with its latest financial results, the story only gets juicier. The company’s earnings call for Q4 of 2025 reveals not just figures, but a triumph of technological prowess and strategic foresight. With a staggering revenue of $39.3 billion for the quarter—up 78% from the previous year—Nvidia has once again shattered its own records, painting a vivid picture of its dominating presence in the tech industry.

At the heart of this success lies Nvidia’s Data Center segment, a powerhouse in every sense. The segment’s revenue alone reached an astounding $115.2 billion for fiscal 2025, more than double the previous year’s figures. Driving this are the groundbreaking advancements in Nvidia’s Blackwell architecture, a technological marvel engineered for the demands of modern AI. Sales from Blackwell exceeded $11 billion in the fourth quarter, marking the fastest product ramp in the company’s history, akin to a rocket launch that defies the limits of speed and scale.

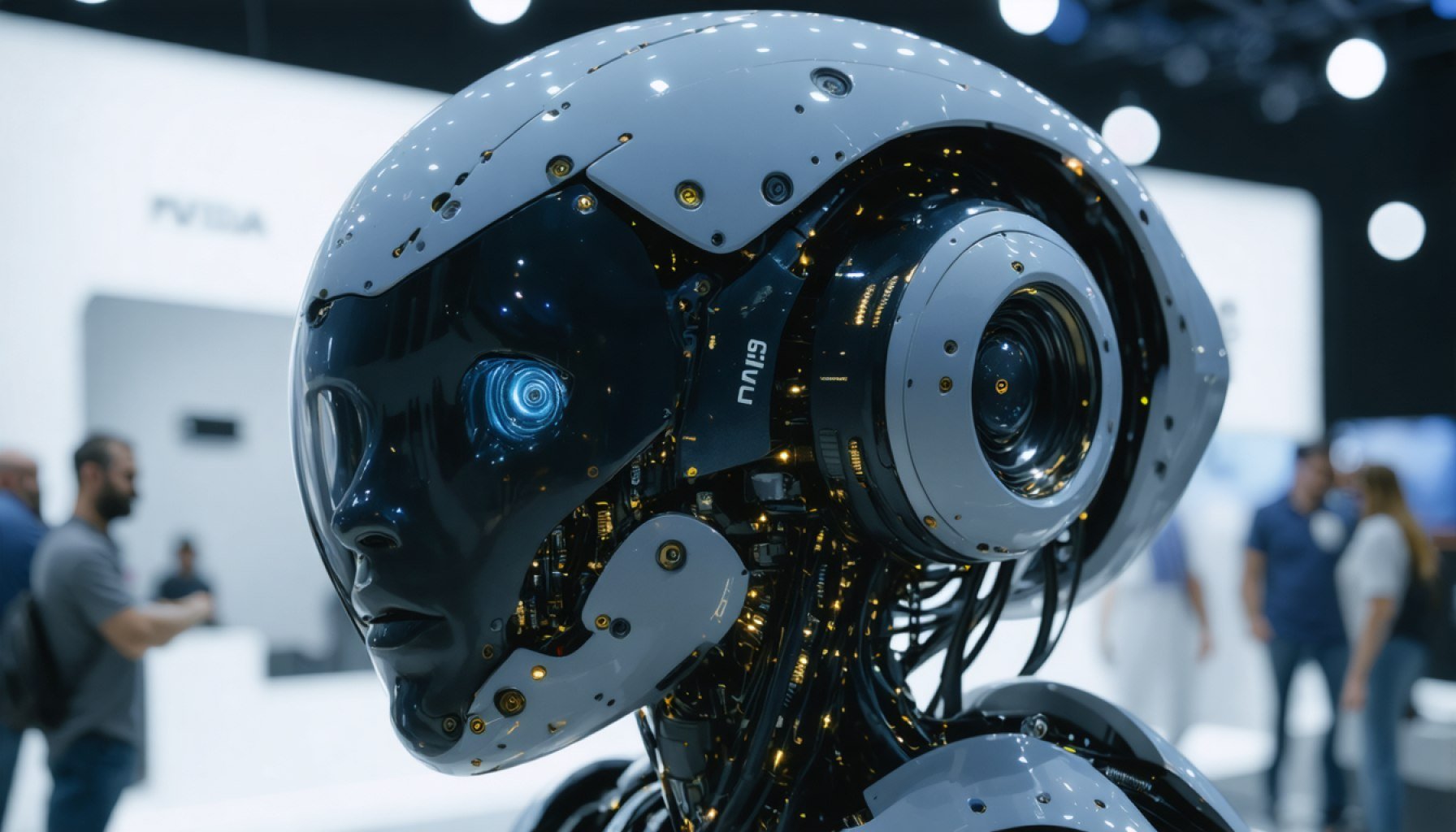

Imagine rows upon rows of powerful hardware humming in synchronized efficiency, fueling the next generation of AI models. Businesses are not just adopting but racing to scale infrastructure—each installation beginning with a jaw-dropping minimum of 100,000 GPUs. It’s a feverish contest to unleash AI capabilities that were once the stuff of science fiction. The demand for post-training and model customization is skyrocketing, with companies leveraging Nvidia’s powerful infrastructure to fine-tune AI models for specialized use cases—a process demanding exponentially more computing power than pre-training.

And as the demand for AI-powered reasoning increases, Nvidia finds itself at the epicenter of this revolution. New reasoning models, such as those by OpenAI and others, require vast computing resources, and Nvidia’s Blackwell architecture delivers. The architecture’s design optimizes reasoning AI inferences, dramatically enhancing token throughput while reducing costs.

What’s the key takeaway? It’s speed, it’s scale, and it’s innovation—all wrapped into one explosive package that’s reshaping industries. Nvidia continues to redefine the possibilities of AI technology, and its relentless pursuit of innovation ensures it remains not just a participant but a leader in the unfolding narrative of artificial intelligence. For tech enthusiasts and industry leaders alike, Nvidia’s recent results are more than an earnings report—they’re an electrifying chapter in the ongoing saga of technological evolution.

Unveiling the Future of AI with Nvidia: Skyrocketing Profits and Revolutionary Technology

An Inside Look at Nvidia’s Financial Triumph

Nvidia’s Q4 2025 financial performance showcases an impressive milestone, underscoring how the company is redefining the tech landscape. The tech giant reported a whopping $39.3 billion in quarterly revenue, a remarkable 78% increase from the previous year. This leap propels Nvidia ahead in the competitive realm of artificial intelligence (AI) and data center innovations.

Key Segment: Data Centers

– 2025 Revenue: The Data Center segment alone surpassed $115.2 billion for fiscal 2025, more than doubling previous year figures.

– Blackwell Architecture: Central to this growth is Nvidia’s Blackwell architecture, particularly noted for its massive $11 billion sales in the fourth quarter. This reflects its record-breaking ramp-up speed and efficiency, contributing significantly to Nvidia’s bottom line.

Expanding the AI Landscape: How Nvidia Leads the Charge

As AI evolves from niche applications to mainstream necessity, Nvidia stands at the forefront, catering to a rapidly expanding market with its hardware and software solutions. Here’s how Nvidia maintains its competitive edge:

1. Boosting AI Capabilities

– AI Model Customization: With the rising need for post-training and bespoke AI models, companies use Nvidia’s infrastructure to customize models, requiring immense computing capabilities.

2. Meeting the Demand

– GPUs in Demand: Installing a minimum of 100,000 GPUs has become a standard starting point for infrastructure scaling, fostering a competitive landscape for AI capabilities.

3. Optimizing AI Reasoning

– Nvidia’s Blackwell architecture optimizes reasoning AI inferences with enhanced token throughput and reduced costs, meeting the escalating demand for AI-powered reasoning.

Industry Impact and Future Trends

Real-World Use Cases and Trends:

– Nvidia’s technology is reshaping industries like healthcare, automotive, and finance by enabling advanced AI applications.

– Future trends include the progression of AI-generated content in media and expanding AI’s role in autonomous vehicles.

Market Forecast and Expert Insights

Industry experts predict continuous growth in AI-driven sectors, with Nvidia playing a pivotal role. The AI market is projected to grow at a CAGR of 40% over the next five years, with Nvidia positioned to capitalize on this expansion through its innovative and scalable solutions.

Pros and Cons Overview

Pros:

– Leading in AI hardware and software capabilities.

– Proven scalability evidenced by record-breaking revenue and product sales.

– Investment in R&D to maintain technological advancement.

Cons:

– High costs associated with infrastructure scaling.

– Intense competition from other tech giants which could impact future profitability margins.

Final Recommendations

For tech companies and enthusiasts looking to harness Nvidia’s groundbreaking technology:

– Embrace Customization: To stay competitive, leverage Nvidia’s infrastructure for fine-tuning AI models tailored to your business needs.

– Invest in Scaling: Consider scaling AI capabilities using Nvidia’s robust hardware, ensuring readiness for future technological demands.

For more on Nvidia’s latest ventures and insights on AI advancements, visit the official NVIDIA website. Prepare to be at the cutting edge of AI technology, as Nvidia continues to reshape the future of innovation.