- Warren Buffett, traditionally a value investor, is shifting focus towards artificial intelligence and cutting-edge technologies.

- Berkshire Hathaway has started investing in leading AI development firms, marking a strategic change for Buffett.

- This pivot reflects the recognition of AI’s transformative potential, comparable to the internet’s impact.

- Buffett emphasizes the ethical deployment of AI, advocating for its alignment with human welfare.

- The move illustrates Buffett’s adaptability and highlights the importance of innovation in investment strategies.

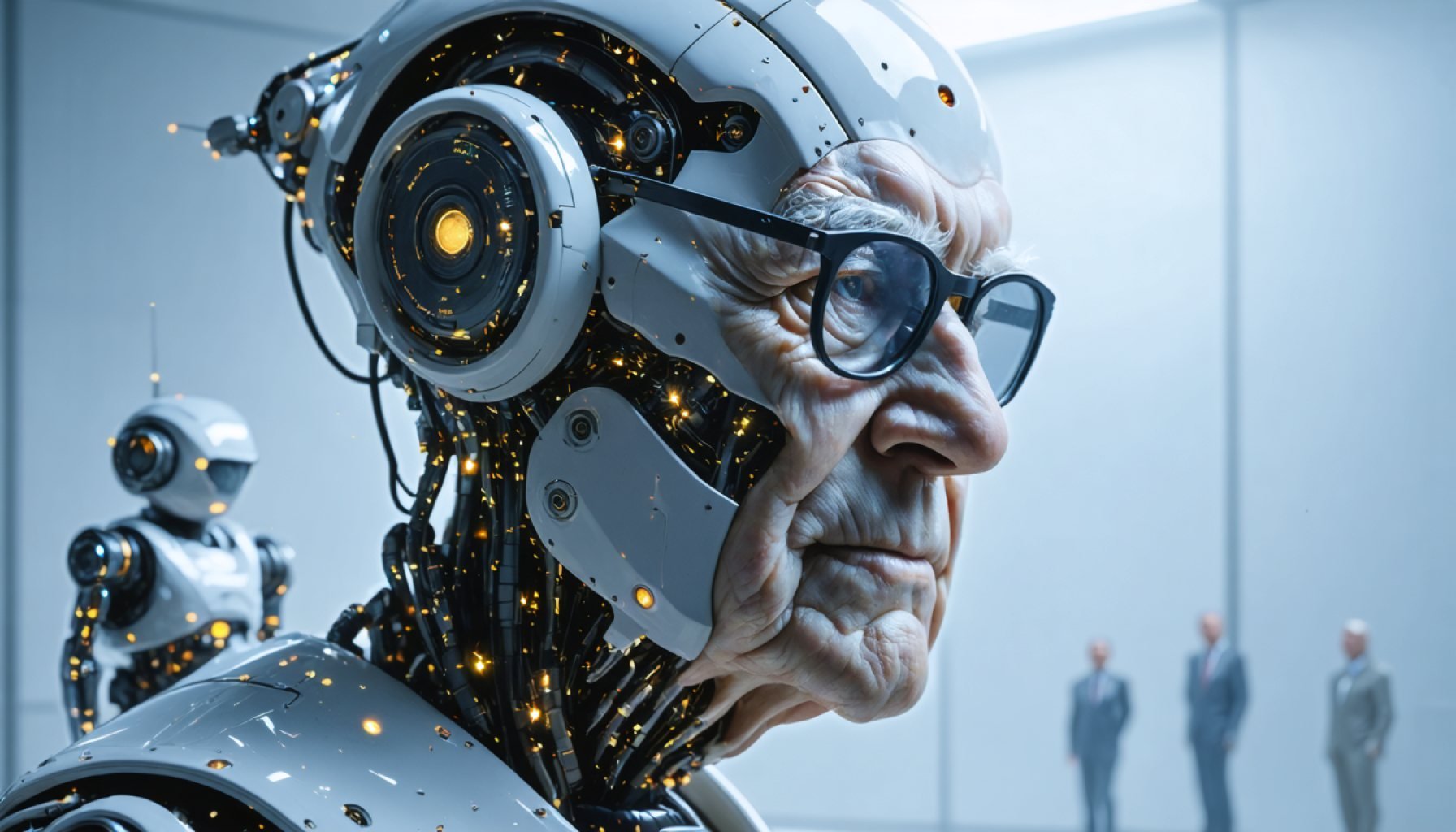

Renowned for his traditional investment principles, Warren Buffett, the “Oracle of Omaha,” is now turning his focus towards the fast-evolving landscape of artificial intelligence and cutting-edge technologies. For decades, Buffett has been a figurehead of value investing, a strategy rooted in fundamental analysis and long-term holds. However, the recent advancements in AI and machine learning have caught his discerning eye, prompting a strategic pivot in his investment approach.

Buffett’s firm, Berkshire Hathaway, has recently initiated investments in technology firms at the forefront of AI development. This move marks a significant shift from Buffett’s historical cautionary stance on tech stocks. The octogenarian investor acknowledges the transformative potential of AI, equating its impact to that of the internet and noting its capacity for global economic disruption.

Interestingly, Buffett’s new direction isn’t purely about financial returns. He recently emphasized the ethical dimensions of AI and its societal implications, advocating for responsible deployment to ensure technological advancements align with human welfare. This perspective indicates a broader vision beyond mere profits, focusing on sustainable and equitable growth.

As Warren Buffett embraces the future and integrates AI into his investment philosophy, it demonstrates a notable evolution. His journey from conventional strategies to recognizing AI’s profound potential showcases the dynamic nature of investment philosophies in response to technological innovations. This shift not only reaffirms Buffett’s adeptness at navigating changing markets but also highlights the indispensable role of innovation in shaping future investment landscapes.

Warren Buffett’s AI Leap: A Game-Changer for Investors?

How is Warren Buffett’s investment strategy evolving with AI?

Warren Buffett, long known for his traditional value investing approach, is making a marked shift in his strategy by incorporating artificial intelligence (AI) into his investment decisions. This is a significant departure from his historical caution towards tech stocks. By investing in technology firms leading AI development through his firm, Berkshire Hathaway, Buffett is embracing the transformative power of AI, which he equates to the impact of the internet. This strategic pivot underscores a recognition of AI’s potential in disrupting global economies and dictating future market trends.

What are the implications of Buffett’s interest in ethical AI deployment?

Buffett’s focus isn’t solely on the financial potential of AI; he’s also concerned about its ethical implications. He advocates for responsible AI deployment to align technological growth with human welfare. This perspective reveals his commitment to sustainable and equitable growth, prioritizing ethical considerations alongside financial returns. As AI continues to develop, his stance encourages a balanced approach to innovation that considers societal impact and long-term benefits.

How might Buffett’s AI investments shape future market trends?

Buffett’s integration of AI into his investment strategy indicates a broader trend of incorporating technology into traditional investment models. This evolution is poised to influence future market trends by highlighting the importance of innovation in investment decisions. His shift reflects the dynamic nature of investment philosophies, where embracing technological advancements becomes crucial. This not only proves Buffett’s skill in adapting to market changes but also sets a precedent for other investors to consider AI’s role in economic growth and innovation.

As Buffett navigates these uncharted waters, investors are likely to observe a continued merging of technology with traditional investment strategies, shaping a new path forward.

For more insights into technological investments, visit the Berkshire Hathaway website.